Bond yield formula

Yield spread is the difference between the yield to maturity on different debt instruments. It is calculated as the percentage of the annual coupon payment to the bond price.

Yield To Call Meaning Formula Example And More In 2022 Accounting Books Financial Management Investing

The YTM of 74 calculated here is for a single bond.

. To use bond price equation you need to input the following. CY C P 100 or CY B CR 100 P. The calculator uses the following formula to calculate the current yield of a bond.

Bond Equivalent Yield - BEY. The exact formula is. Current trading price Δyield.

For this particular problem interestingly we start with an estimate before building the actual answer. A bond yield is the return you get for a bond and provides crucial information for evaluating a bonds value and whether its a good fit for your portfolio. Thats right - the actual formula for internal rate of return requires us to converge onto a solution.

In other words a bonds returns are scheduled after making all the payments on time throughout the life of a bond. Bond price when yield increases by 1 Price-1. Percentage point change in yield note that its squared.

To calculate current yield we must know the annual cash inflow of the bond as well as the current market price. Estimated Yield to Maturity Formula. It doesnt allow us to isolate a variable and solve.

Bond Yield to Maturity Formula. For example if a bond has a yield of 55 percent and a Treasury note with the same maturity has a yield of 27 percent the credit spread is 28 percent or 280 basis points. The Yield to Maturity of this bond calculated using the YTM formula mentioned earlier is.

The bond pays out 21 every six months so this means that the bond pays out 42 every year. It is the rate of return that a bondholder earns if he holds the bond till maturity and receive all the. The current market price of the bond is how much the bond is worth in the current market place.

The annual coupon payment is calculated by multiplying the bonds face value with the coupon rate. This might tell more about the. Common examples of yield spreads are g-spread i-spread zero-volatility spread and option-adjusted spread.

Some of the calculations that are relevant for the bond market are Yield to maturity Yield To Maturity The yield to maturity refers to the expected returns an investor anticipates after keeping the bond intact till the maturity date. The bond equivalent yield BEY allows fixed-income securities whose payments are not annual to be compared with securities with annual yields. Several types of bond yields exist including nominal yield which is the interest paid divided by the face value of.

Bond price is calculated as the present value of the cash flow generated by the bond namely the coupon payment throughout the life of the bond and the principal payment or the balloon payment at the end of the bonds lifeYou can see how it changes over time in the bond price chart in our calculator. Take a look at historical bond spreads. The bond yield formula evaluates the returns from investment in a given bond.

CY is the current yield C is the periodic coupon payment P is the price of a bond B is the par value or face value of a bond CR is the coupon rate. As you can see we have assumed that the current market value of Bond X is lower than the Face Value which indicates that it is trading at a discount. With new computing tools traders investors and others can assess bond spreads over time.

A bond yield is the amount of return an investor realizes on a bond. The BEY is a. Bond yield is the internal rate of return of the bond cash flows.

Sign doesnt matter But stick with the better convexity formula if you have time to calculate it or come back and visit this page. YTM 60 1000-90010 10009002 74. Bond price when yield decreases by 1 Price.

How To Calculate Coefficient Of Variation Calculator Standard Deviation Investing

Abbvie Stock Similar To Equity Bond With 12 5 Yield Nyse Abbv Seeking Alpha Equity Bond Bar Chart

Bond Yield To Maturity Calculator Printer Driver Organization Development Results Day

How To Calculate The Yield Of A Zero Coupon Bond Using Forward Rates Bond Calculator Really Cool Stuff

Bond Dv01 And Duration Bond Treasury Bonds 30 30

Bond Yield Calculator Online And Free Www Investingcalc Bond Yield Calculator Free Coupon Rate Current Yield Investing Money How To Get Rich Bond

Bankrate Com Provides A Free Tax Equivalent Yield Calculator And Other Tey Calculators To View The Yield Of Your Municipal Bonds Calculator Tax Tax Free

What Is Capm Capital Asset Pricing Model Formula Example Capital Assets Finance Quotes Finance

How To Calculate The Molar Mass Of A Compound Quick Easy Youtube In 2022 Molar Mass Molars Chemistry

Excel Formulas For Accounting And Finance Basic Excel Tutorial Accounting And Finance Excel Formula Excel Tutorials

What Is The Definition Of Interest Napkin Finance Has Your Answer Finance Investing Financial Literacy Lessons Accounting And Finance

Bond Financing And Bond Investing Principles Metrics Ratings Bond Investing Principles

Bond Yield Calculator 嵐天看投資sky S Views On Investing Smartskyinvest Com 分享投資知識 經驗及交易記錄 股票 債券 房地產投資信託基金 期權sharing Of Investment Knowledge Experience And Transaction Records Stocks Bonds

Must Know Cfa Formulas Business Insider Fisher College Of Business Business Insider Formula

Bond Etf Buyer S Guide 2016 Bond Funds Bond Buyers Guide

Pin On Chemistry

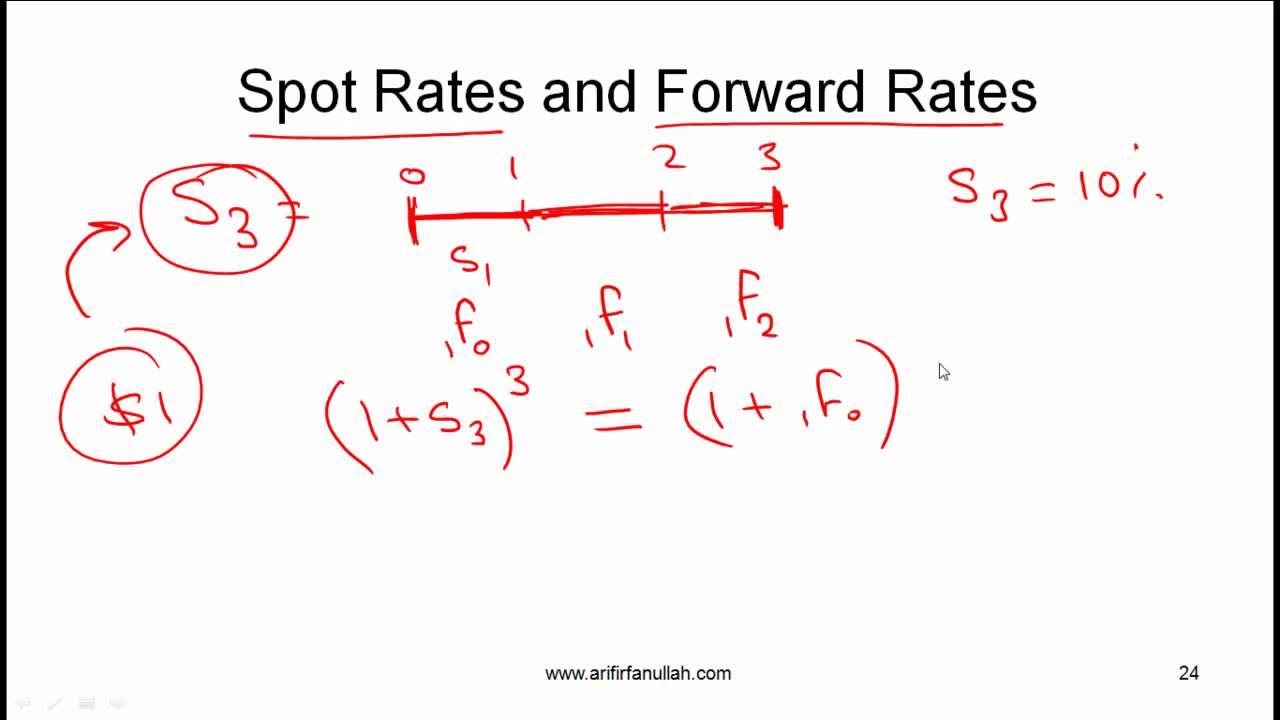

Cfa Level I Yield Measures Spot And Forward Rates Video Lecture By Mr Arif Irfanullah Part 5 Youtube Lecture Mr Video